In today’s globalized world, international banking transactions have become commonplace. Whether you need to send or receive money from overseas, having the right information is essential. One such piece of information is the AU Small Finance Bank Swift Code. If you’re not familiar with Swift codes, you’re not alone. These unique codes play a crucial role in international banking, facilitating secure and efficient transfers across borders.

In this comprehensive guide, we’ll unlock the secrets behind AU Small Finance Bank’s Swift Code. We’ll explain what a Swift code is, why it’s important, and how to find AU Small Finance Bank’s specific code. Additionally, we’ll delve into the features and services offered by AU Small Finance Bank, giving you a complete understanding of their offerings. Whether you’re a frequent international transactor or just curious about banking codes, this article will provide you with all the information you need to know about AU Small Finance Bank Swift Codes.

Importance of Swift Codes in International Banking

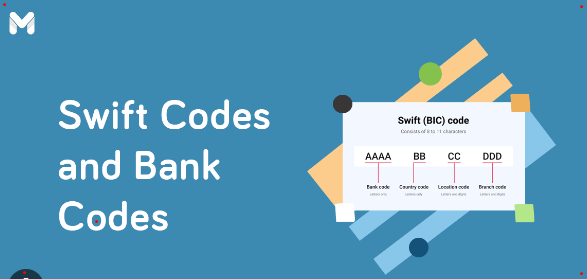

A Swift code, also known as a Bank Identifier Code (BIC), is a unique identification code used by banks worldwide to facilitate international transactions. It is a standardized format consisting of alphanumeric characters and is used to identify specific banks and branches. Swift codes are essential for ensuring the accuracy and security of cross-border transactions. They enable banks to communicate securely and efficiently, ensuring that funds are transferred to the correct recipient. Without a Swift code, international transactions would be challenging, time-consuming, and prone to errors. Swift codes are regulated by the Society for Worldwide Interbank Financial Telecommunication (SWIFT), a global cooperative organization based in Belgium that oversees international financial transactions.

The Importance of Swift Codes in International Banking

Swift codes play a vital role in international banking for several reasons. Firstly, they provide a standardized format for identifying banks and branches, eliminating the possibility of errors during the transfer process. This ensures that funds are sent to the correct recipient without delay. Secondly, Swift codes enable banks to communicate securely, ensuring the confidentiality of sensitive financial information. This is particularly important in an era where cybersecurity threats are on the rise. Thirdly, Swift codes facilitate the automation of international transactions, making the process faster and more efficient. This automation reduces manual errors and streamlines the overall transfer process. Overall, Swift codes are essential for ensuring the smooth operation of international banking transactions.

Understanding AU Small Finance Bank Swift Code Format

AU Small Finance Bank’s Swift code follows the standard format used by most banks. It consists of either 8 or 11 characters, which can be divided into three parts. The first four characters represent the bank’s code, the next two characters identify the country where the bank is located, and the last two characters represent the bank’s location. In some cases, an additional three characters may be added to specify a branch. For AU Small Finance Bank, the Swift code is AUBLINBBXXX. Here, « AUBL » represents the bank’s code, « IN » represents India as the country code, and « BB » represents the bank’s location. The « XXX » at the end signifies that it is the head office or the main branch. It’s essential to note that the Swift code format may vary slightly for different banks, but the basic structure remains the same.

How to Find AU Small Finance Bank Swift Code?

Finding AU Small Finance Bank’s Swift code is a relatively straightforward process. There are several ways to obtain the code:

1. Visit the Bank’s Website: AU Small Finance Bank’s official website is a reliable source of information. Navigate to the bank’s website and look for the « Swift Code » or « Contact Us » section. Here, you should find the Swift code along with other relevant contact details.

2. Contact Customer Service: If you’re unable to find the Swift code on the bank’s website, contacting customer service is an excellent option. Reach out to the bank’s customer service team through phone, email, or live chat, and they will provide you with the necessary information.

3. Use Online Swift Code Directories: There are several online directories available that provide comprehensive lists of Swift codes for various banks worldwide. These directories allow you to search for the Swift code by bank name, country, or branch. Popular directories include SWIFT.com, BankersAlmanac.com, and TheBankCodes.com.

Remember to double-check the Swift code you obtain to ensure its accuracy. A minor error in the Swift code can lead to delays or even the funds being sent to the wrong recipient.

Common Mistakes to Avoid When Using Swift Codes

While Swift codes are essential for international transactions, there are some common mistakes to avoid to ensure a smooth process:

1. Incorrect Swift Code: Double-check the Swift code provided to ensure its accuracy. A wrong Swift code can result in delays or the funds being sent to the wrong recipient.

2. Incomplete Information: Ensure that you have all the necessary information for the international transfer, including the recipient’s full name, bank account number, and any additional details required by the receiving bank.

3. Lack of Confirmation: After initiating an international transfer, it’s essential to obtain confirmation from both your bank and the recipient’s bank to ensure the successful completion of the transaction.

4. Ignoring Fees and Exchange Rates: Consider any fees or exchange rate fluctuations that may affect the final amount received by the recipient. Factor these costs into your decision-making process to avoid surprises.

By being mindful of these common mistakes, you can minimize the risks associated with international transactions and ensure a smooth and secure process.

Alternatives to Swift Codes for International Transactions

While Swift codes are widely used for international transactions, some alternative methods have emerged in recent years. These alternatives aim to provide faster, cheaper, and more transparent cross-border transfers. Some popular alternatives include:

1. International Bank Account Numbers (IBAN): IBANs are used primarily in Europe and are an internationally recognized format for identifying bank accounts. They provide a standardized method for identifying account numbers, making transfers within Europe more efficient.

2. Ripple: Ripple is a digital payment protocol that enables fast, low-cost international transfers using blockchain technology. It aims to revolutionize the traditional banking system by providing real-time settlement and instant liquidity.

3. TransferWise: TransferWise is a peer-to-peer money transfer service that offers competitive exchange rates and lower fees compared to traditional banks. It operates on a global scale, making it an attractive option for individuals and businesses needing to send money internationally.

While these alternatives offer advantages in terms of speed and cost, they may not be as widely accepted or recognized as Swift codes. It’s essential to consider the specific requirements of the receiving bank and the country when choosing an alternative method for international transfers.

AU Small Finance Bank Swift Code FAQs

1. Can I use the same Swift code for all AU Small Finance Bank branches?

No, the Swift code for each branch may vary. It’s crucial to use the correct Swift code for the specific branch you are transacting with.

2. How long does an international transfer using AU Small Finance Bank’s Swift code take?

The time taken for an international transfer can vary depending on various factors, including the receiving bank’s processing time and any intermediary banks involved. It’s best to consult with your bank for a more accurate estimate.

3. Can I use AU Small Finance Bank’s Swift code for domestic transfers within India?

While it’s possible to use AU Small Finance Bank’s Swift code for domestic transfers, it’s not the most efficient method. Domestic transfers within India typically use the Indian Financial System Code (IFSC) instead.

4. Are Swift codes and routing numbers the same?

No, Swift codes and routing numbers are not the same. Swift codes are used for international transfers, while routing numbers are used for domestic transfers within certain countries, primarily the United States.

Conclusion

In conclusion, AU Small Finance Bank Swift codes are an essential component of international banking transactions. These codes facilitate secure and efficient transfers across borders, ensuring that funds reach the correct recipient without delay. Understanding the format and importance of Swift codes is crucial for anyone involved in international transactions. By following the guidelines outlined in this article, you can ensure a smooth and secure transfer process. Whether you’re a frequent international transactor or simply curious about banking codes, having knowledge of AU Small Finance Bank Swift codes will prove invaluable in navigating the global financial landscape.

How to Find AU Small Finance Bank Swift Code?

AU Small Finance Bank’s Swift code follows the standard format used by all banks and financial institutions. It consists of eight or eleven characters, combining both letters and numbers. Let’s break down the AU Small Finance Bank Swift code format to better understand its components.

The first four characters of the Swift code represent the bank’s identifier, known as the Bank Code. For AU Small Finance Bank, the Bank Code is « AUBL. » These characters uniquely identify AU Small Finance Bank among all other banks worldwide.

The next two characters represent the country code, which indicates the country where the bank is located. For AU Small Finance Bank, the country code is « IN, » which stands for India. This code ensures that the funds are routed to the correct country.

The following two characters form the location code, which specifies the city or branch of the bank. In AU Small Finance Bank’s case, the location code may vary depending on the specific branch or city. It is important to note that not all Swift codes include a location code.

Lastly, the optional three characters at the end of the Swift code represent the branch code. This code further identifies a specific branch within a city. Not all banks use a branch code, so it may be omitted in some cases.

To summarize, AU Small Finance Bank’s Swift code follows the format: AUBLINXX, where « AUBL » is the Bank Code, « IN » is the country code, « XX » is the location code, and the optional three characters represent the branch code.

Now that you understand the format of AU Small Finance Bank’s Swift code, let’s explore how to find it.

Common Mistakes to Avoid When Using Swift Codes

Finding AU Small Finance Bank’s Swift code is relatively straightforward. There are several methods you can use to obtain the correct Swift code, depending on your preference and convenience. Here are some common ways to find AU Small Finance Bank’s Swift code:

1. AU Small Finance Bank’s Website: The official website of AU Small Finance Bank is a reliable source for finding their Swift code. Visit the bank’s website and navigate to the section that provides information for international transactions. Look for the Swift code, which may be listed as « BIC » or « Bank Identifier Code. »

2. Online Swift Code Directories: Numerous online directories specialize in providing Swift codes for various banks worldwide. These directories allow you to search for AU Small Finance Bank’s Swift code by entering the bank’s name or location. Ensure that you use a reputable and up-to-date directory to obtain accurate information.

3. Contact AU Small Finance Bank: If you prefer direct communication, you can contact AU Small Finance Bank’s customer service or visit a branch to inquire about their Swift code. The bank’s representatives will be able to provide you with the correct code and any additional information you may require.

When using any of these methods, it’s essential to double-check the Swift code to ensure its accuracy. Mistakes in entering the Swift code can lead to delays or misrouted funds. In the next section, we’ll discuss some common mistakes to avoid when using Swift codes.

AU Small Finance Bank Swift Code FAQs

While Swift codes have been the standard for international banking transactions for decades, alternative methods have emerged in recent years. These alternatives aim to provide faster, cheaper, and more transparent cross-border transfers. Here are some popular alternatives to Swift codes:

1. IBAN (International Bank Account Number): IBAN is a standardized format for bank account numbers used in European countries and several other countries worldwide. It simplifies the identification of bank accounts and ensures accurate transfers within the participating countries. If you’re sending money to a country that uses IBAN, you may not need a Swift code.

2. Blockchain Technology: Blockchain technology, primarily through cryptocurrencies like Bitcoin, has gained popularity as an alternative to traditional banking systems. Blockchain enables peer-to-peer transfers without the need for intermediaries such as banks. While still evolving, blockchain-based transfers offer faster processing times and lower fees compared to traditional methods.

3. Fintech Companies: With the rise of fintech companies, several digital platforms have emerged that offer cross-border payment solutions. These platforms often provide faster transfers, competitive exchange rates, and user-friendly interfaces. Examples include TransferWise, PayPal, and Payoneer.

It’s important to evaluate the specific requirements of your transaction and the available options before deciding on an alternative to Swift codes. Each alternative has its advantages and limitations, so choose the method that best suits your needs.