Are you tired of the bank queues and the never-ending paperwork? AU Small Finance Bank is here to make your banking transactions hassle-free and convenient. With the AU Small Finance Bank IFSC Code in Delhi, you can easily conduct all your banking transactions from the comfort of your home or office. The AU Small Finance Bank IFSC Code is a unique 11-digit alphanumeric code that identifies the bank branch and ensures secure and accurate transfer of funds. Whether you need to make a payment, transfer money to another bank account, or receive funds from abroad, having the correct IFSC code is essential. In this essential guide, we will provide you with all the information you need to know about AU Small Finance Bank IFSC Code in Delhi. We will guide you on how to find the code, how to use it for different banking transactions, and answer any questions you may have. Say goodbye to the long wait times and endless paperwork. Start enjoying hassle-free banking with AU Small Finance Bank today.

I. What is an IFSC code?

The IFSC (Indian Financial System Code) is a unique 11-character alphanumeric code that is a prerequisite for conducting electronic funds transfer in India. It plays a crucial role in enabling secure and efficient interbank transactions within the country. This code is issued by the Reserve Bank of India (RBI) to each individual bank branch that participates in various electronic payment mechanisms such as NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service).

II. Importance of IFSC code in banking transactions

The importance of the IFSC code in modern-day banking transactions cannot be overstated. It serves as a vital element in the seamless routing and verification of funds during electronic transfers. The IFSC code acts as a unique identifier that ensures the accurate and secure transfer of funds between different bank accounts, enabling individuals and businesses to conduct various financial transactions without any hindrances.

III. How to find AU Small Finance Bank IFSC code in Delhi?

Locating the specific IFSC code for AU Small Finance Bank in Delhi is an easy and straightforward process. Individuals can access this information through multiple channels, including the official website of AU Small Finance Bank, the RBI website, and other reliable third-party financial platforms that provide comprehensive and up-to-date banking information. Additionally, customers can visit the nearest AU Small Finance Bank branch in Delhi for assistance in obtaining the accurate IFSC code.

IV. Understanding the structure of AU Small Finance Bank IFSC code

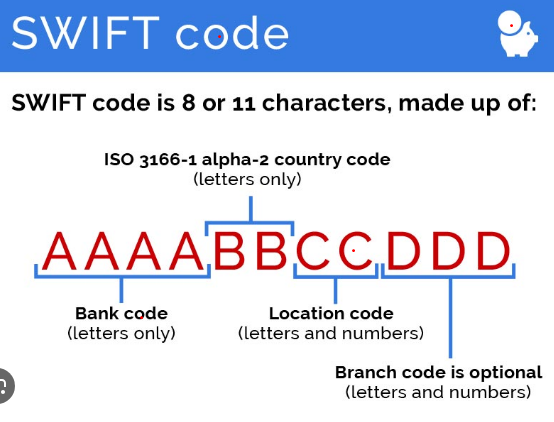

The IFSC code for AU Small Finance Bank follows a specific format that includes 11 characters, each serving a distinct purpose. The first four characters represent the bank’s name, the fifth character is typically ‘0’, reserved for future use, and the remaining six characters denote the unique branch code. Understanding this structure is essential for ensuring the accurate input and utilization of the IFSC code during any electronic fund transfer process.

V. Benefits of using AU Small Finance Bank IFSC code for banking transactions

The utilization of the AU Small Finance Bank IFSC code offers a myriad of advantages, making it an indispensable component for seamless and secure electronic fund transfers. Customers can enjoy the convenience of initiating a variety of financial transactions, including NEFT, RTGS, and IMPS transfers, with the assurance of prompt and accurate fund routing, all while ensuring adherence to the highest security standards.

Utilizing the AU Small Finance Bank IFSC code for banking transactions, particularly in Delhi, offers a multitude of distinct advantages for customers, significantly simplifying and securing their day-to-day banking activities.

First and foremost, this code allows for efficient traceability of funds during electronic transfers, ensuring transparency and security in financial transactions within Delhi. By precisely identifying the specific AU Small Finance Bank branch in Delhi involved in the transaction, the IFSC code ensures that funds are directed to the intended recipient, thereby reducing the risk of errors or potential losses specific to transactions in Delhi.

READ :

au small finance bank swift code

Furthermore, the use of the IFSC code greatly facilitates the speed of transfers, enabling swift and real-time transactions through platforms such as NEFT, RTGS, and IMPS, specifically catering to the bustling financial environment of Delhi. This proves particularly advantageous for customers requiring urgent fund transfers within the city, be it for bill settlements, fee payments, or any other operation necessitating immediate responsiveness within Delhi.

VI. Common banking transactions that require IFSC code

The IFSC code is a prerequisite for various banking operations, especially in the digital age where electronic fund transfers have become the norm. Whether it’s conducting online payments, transferring funds to other bank accounts, paying bills, or even making investments, the correct input of the IFSC code is crucial for ensuring that the transaction reaches the intended recipient without any delays or complications.

VII. Tips for hassle-free banking transactions with AU Small Finance Bank IFSC code

To facilitate a smooth and error-free banking experience, it is essential for customers to exercise certain precautions when utilizing the AU Small Finance Bank IFSC code. Double-checking the accuracy of the IFSC code before initiating any fund transfer is highly recommended to avoid potential errors or misrouting of funds. Staying informed about any updates or changes to the IFSC code is equally vital to ensure that all banking transactions proceed seamlessly without any disruptions.

Navigating banking transactions with the AU Small Finance Bank IFSC code in Delhi, particularly the Preet Vihar branch, can be a streamlined experience with a few helpful tips to ensure a hassle-free process. Firstly, it is advisable to double-check the accuracy of the IFSC Code before initiating any transaction, as any minor discrepancy can lead to delays or unsuccessful fund transfers. Verifying the IFSC Code against the official records of AU Small Finance Bank is crucial to avoid potential errors.

Secondly, staying informed about any updates or changes to the IFSC Code is paramount. Banks occasionally update their codes, and being aware of these modifications can prevent any disruptions in the transaction process. Regularly checking the official website of AU Small Finance Bank or contacting their customer service can provide the latest and most accurate information.

Thirdly, it is essential to be cautious of potential fraudulent activities. Customers should ensure that they are entering the IFSC Code on secure and verified platforms to prevent any unauthorized access to their accounts. Being vigilant about sharing personal banking information and avoiding suspicious links or emails can safeguard against fraudulent practices.

Furthermore, maintaining a record of past transactions and cross-verifying them with the IFSC Code used can serve as a useful practice. This can help in tracking and reconciling any discrepancies that may arise during the transfer process, providing an added layer of security and transparency in banking transactions.

Lastly, seeking guidance from the customer support team of AU Small Finance Bank for any queries or concerns related to the IFSC Code, including details mentioned in the Economic Times and the Preliminary Placement Document for QIBs, can offer prompt solutions and assistance. The customer service representatives can provide valuable insights and guidance, ensuring a smooth and efficient banking experience for customers using the AU Small Finance Bank IFSC code in Delhi.

VIII. FAQs about AU Small Finance Bank IFSC code in Delhi

- How frequently does the IFSC code for a specific bank branch get updated?

- Are there any restrictions on the frequency or amount of funds that can be transferred using the AU Small Finance Bank IFSC code?

- Can the AU Small Finance Bank IFSC code be used for international fund transfers as well?

IX. Conclusion: Simplify your banking transactions with AU Small Finance Bank IFSC code

In conclusion, the AU Small Finance Bank IFSC code acts as the linchpin for ensuring the smooth and secure transfer of funds across various electronic platforms. By comprehending its significance and following the recommended guidelines, customers can effectively streamline their banking operations and indulge in hassle-free financial transactions with AU Small Finance Bank in Delhi. As technology continues to revolutionize the banking sector, the role of the IFSC code remains paramount in fostering a robust and efficient financial ecosystem that caters to the diverse needs of customers and businesses alike.